Cost of recruitment offerings & price trends in India

In India, the recruitment spend is in these 2 categories

Job portals and resume databases (Naukri and LinkedIn are the largest players)

Recruitment agencies

How is the market adoption of these offerings and what are their price trends?

We did a webinar and survey on this topic recently

Last Thursday, we did an interesting webinar on where AI will disrupt the existing recruitment market offerings. 150+ TA leaders and agency business owners attended and many stayed for an extended 1 hour after the scheduled closing time!

A a part of this webinar, we also did a survey to understand how companies utilise these offerings and their pricing experiences.

Cost of Recruitment Offerings and Pricing Trends in India

This survey revealed interesting trends. Some I expected, some surprised me.

Key pricing insights

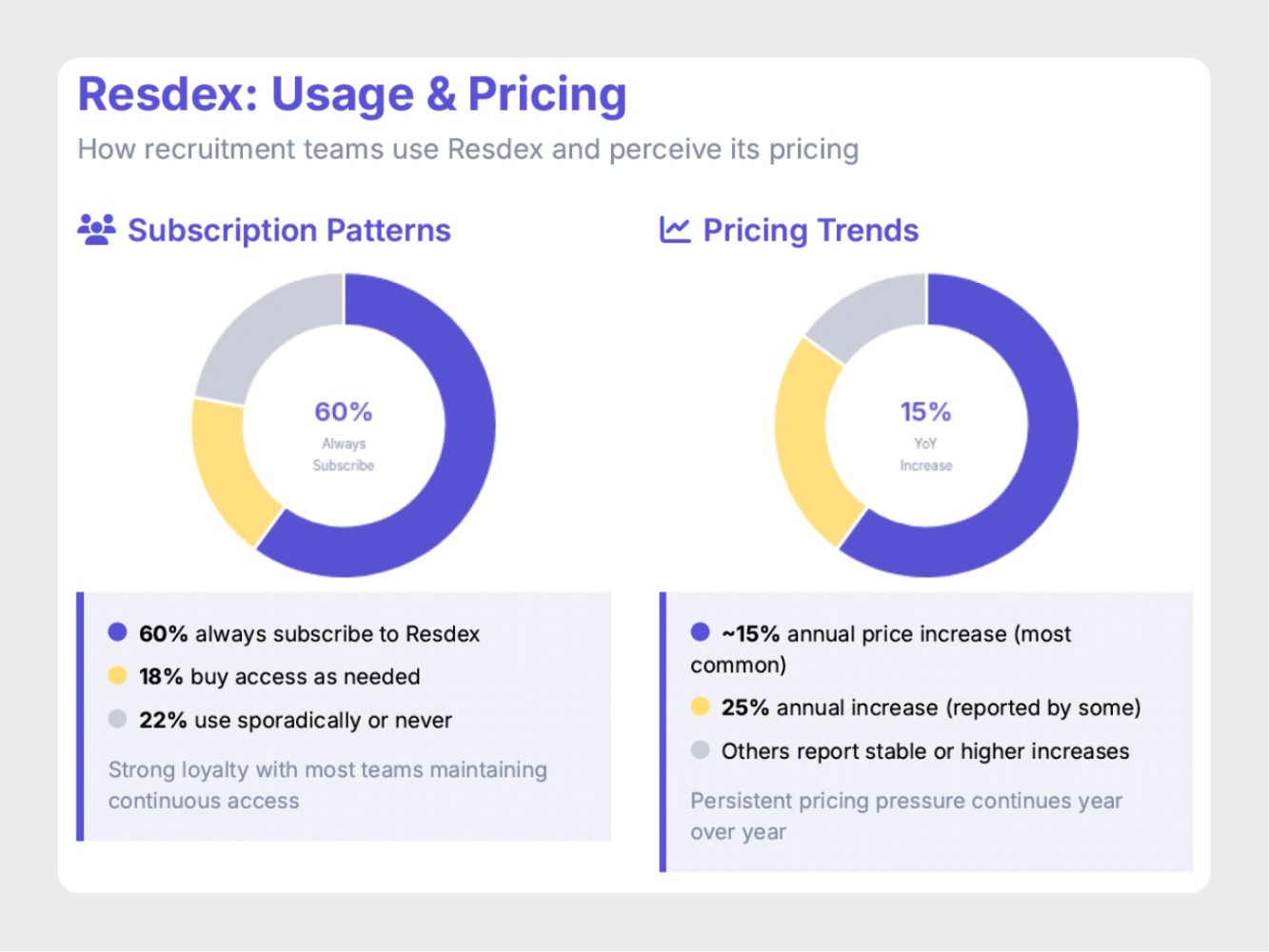

Naukri Resdex is the de-facto option: 78% bought Naukri Resdex regularly or when they needed. 15% yearly hikes in Naukri pricing is most commonly reported. 25% was reported quite commonly as well.

LinkedIn is a little less aggressive with price increases but 15% is pretty common there too.

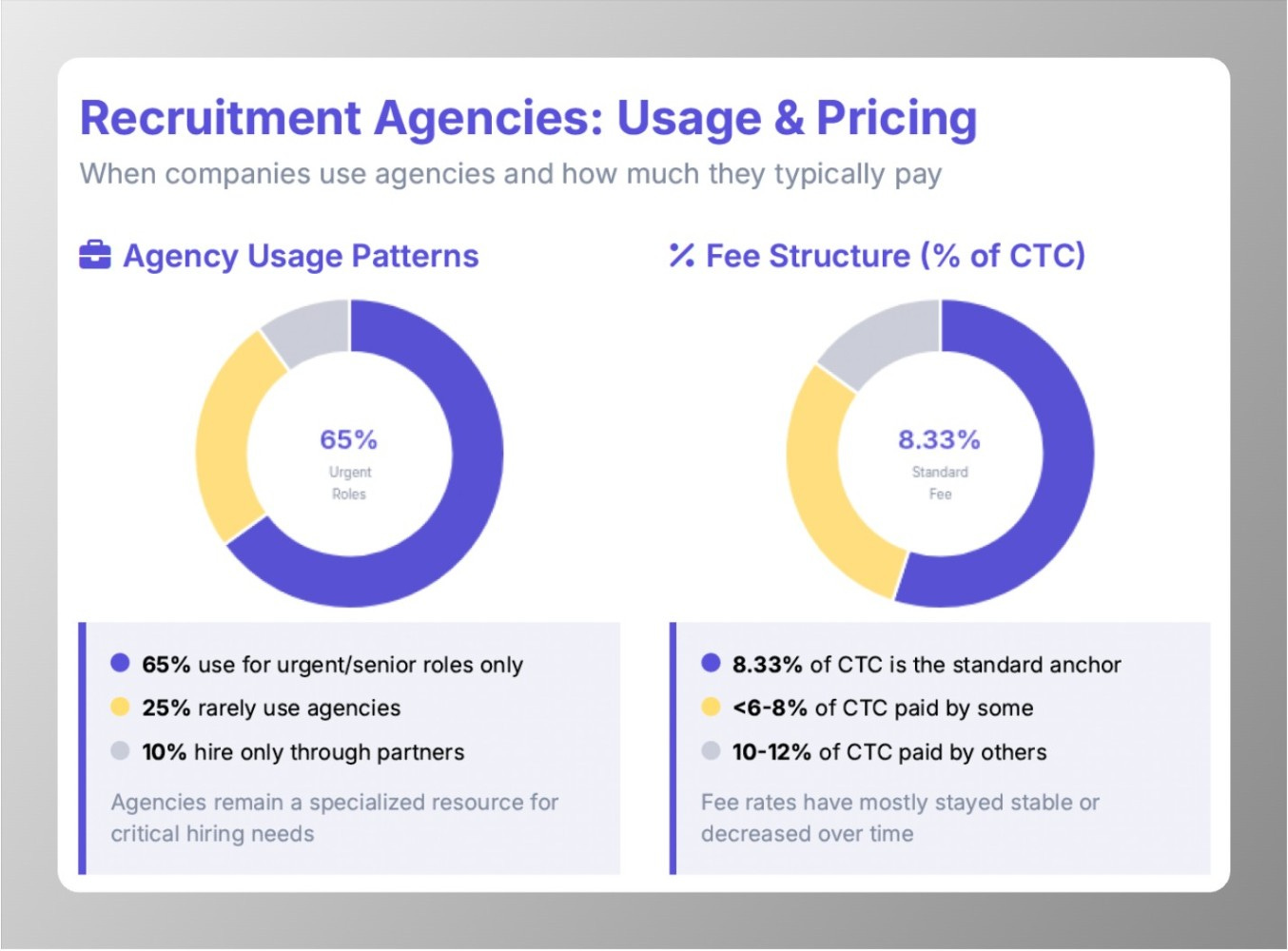

Recruitment agencies pricing: 8.33% continues to remain most common.

Other recruitment function related findings:

30% leaders believe AI has increased recruiter productivity. But an overwhelming 45% have not measured this yet.

Pricing satisfaction: Largely the sentiment is they are not happy with the cost vs the value equation of recruitment offerings.

Other recruitment function related findings

AI adoption: 30% of leaders believe AI has already improved recruiter productivity. But an even larger 45% admit they haven’t measured AI’s impact yet — suggesting we’re still at an early stage of adoption and awareness.

Pricing satisfaction: The overall sentiment is clear: most recruitment leaders are not happy with the cost vs value equation. In fact, when asked to rate satisfaction with recruitment costs, the majority scored it only 2–3 out of 5 (unhappy to neutral). Rising costs of job portals and LinkedIn licenses were the top pressure points.

The takeaway

Recruitment market in india shows the classic signs of a large market with clear category leaders, but customers not being happy with them.

Resdex and LinkedIn continue to increase prices by ~15% (and sometimes 25%) every year.

Agency fees have remained more stable at 8.33% of CTC, though usage is highly specialized (mostly urgent or senior hires).

AI is starting to provide productivity gains — but most teams are yet to quantify this.

In short: pricing pressure is real, satisfaction is low, and the search for better ROI is on.

We believe AI has the best chance to change this market dynamic. It can create better offerings in terms of quality and speed while also offering significant better ROI.

Cutshort’s Sourcing-only model at 3.5% success fees is one such example. We believe more offerings will soon follow in the market which will make it interesting.

Full survey report now available on Cutshort website

Check out the full survey report on Cutshort website here:

Some excerpts from this report are here:

Naukri Resdex pricing trends:

When companies use recruitment agencies and at what price:

We also wrote a detailed blog post to cover this in more detail